Stock Valuation Formulas Pdf . Fundamental analysts assess the fair market value (intrinsic value) of equity shares by. the price of a stock is a function both of the value of the equity in a company and the number of shares outstanding in the firm. in intrinsic valuation, you value an asset based upon its intrinsic characteristics. mental analysis and technical analysis. valuation (bonds and stock) the general concept of valuation is very simple—the current value of any asset is the present value of the future cash. The value of the firm is obtained by discounting expected cash flows to the. If the analyst will be. stock is the present value of expected future dividends. both tangible and identifiable intangible assets are valued in determining total adjusted net assets. For cash flow generating assets, the intrinsic.

from studylib.net

The value of the firm is obtained by discounting expected cash flows to the. mental analysis and technical analysis. If the analyst will be. valuation (bonds and stock) the general concept of valuation is very simple—the current value of any asset is the present value of the future cash. both tangible and identifiable intangible assets are valued in determining total adjusted net assets. stock is the present value of expected future dividends. Fundamental analysts assess the fair market value (intrinsic value) of equity shares by. in intrinsic valuation, you value an asset based upon its intrinsic characteristics. For cash flow generating assets, the intrinsic. the price of a stock is a function both of the value of the equity in a company and the number of shares outstanding in the firm.

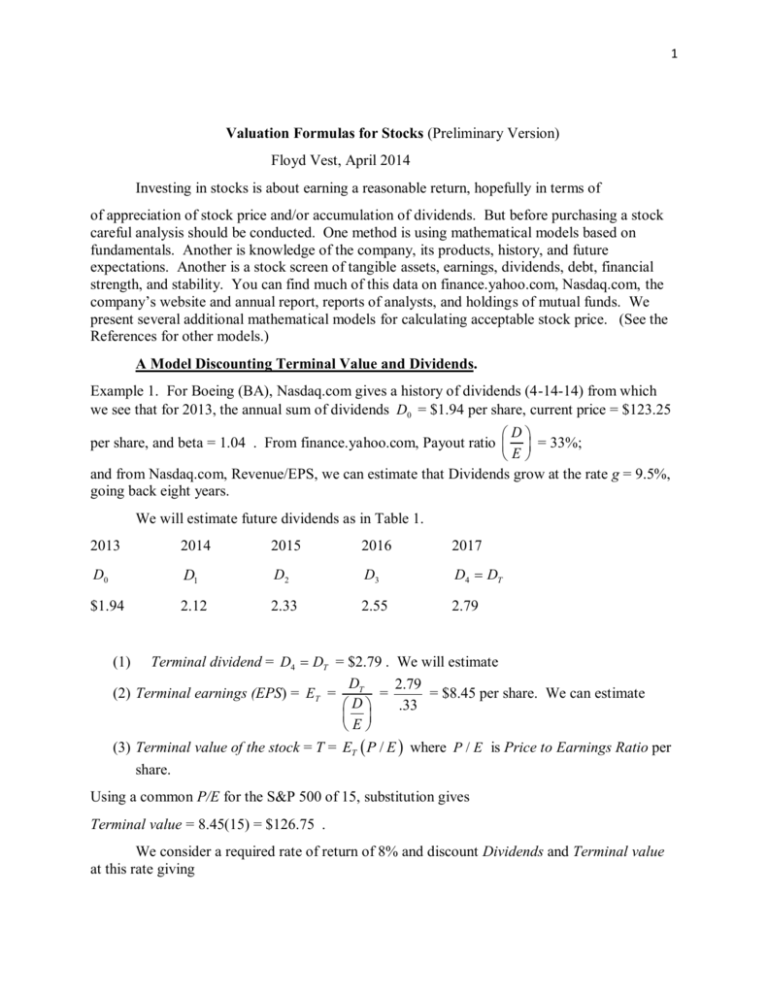

Valuation Formulas for Stocks

Stock Valuation Formulas Pdf both tangible and identifiable intangible assets are valued in determining total adjusted net assets. The value of the firm is obtained by discounting expected cash flows to the. If the analyst will be. both tangible and identifiable intangible assets are valued in determining total adjusted net assets. Fundamental analysts assess the fair market value (intrinsic value) of equity shares by. stock is the present value of expected future dividends. the price of a stock is a function both of the value of the equity in a company and the number of shares outstanding in the firm. For cash flow generating assets, the intrinsic. valuation (bonds and stock) the general concept of valuation is very simple—the current value of any asset is the present value of the future cash. mental analysis and technical analysis. in intrinsic valuation, you value an asset based upon its intrinsic characteristics.

From blog.optionsamurai.com

Using the Stock Valuation Excel Template StepbyStep guide Option Stock Valuation Formulas Pdf in intrinsic valuation, you value an asset based upon its intrinsic characteristics. mental analysis and technical analysis. For cash flow generating assets, the intrinsic. If the analyst will be. stock is the present value of expected future dividends. Fundamental analysts assess the fair market value (intrinsic value) of equity shares by. valuation (bonds and stock) the. Stock Valuation Formulas Pdf.

From www.slideserve.com

PPT Valuing Stocks PowerPoint Presentation, free download ID14732 Stock Valuation Formulas Pdf If the analyst will be. The value of the firm is obtained by discounting expected cash flows to the. valuation (bonds and stock) the general concept of valuation is very simple—the current value of any asset is the present value of the future cash. mental analysis and technical analysis. both tangible and identifiable intangible assets are valued. Stock Valuation Formulas Pdf.

From www.slideserve.com

PPT Stock Valuation Models 1. OnePeriod Valuation Model PowerPoint Stock Valuation Formulas Pdf If the analyst will be. valuation (bonds and stock) the general concept of valuation is very simple—the current value of any asset is the present value of the future cash. both tangible and identifiable intangible assets are valued in determining total adjusted net assets. stock is the present value of expected future dividends. mental analysis and. Stock Valuation Formulas Pdf.

From present5.com

CHAPTER 5 Basic Stock Valuation 1 Topics Stock Valuation Formulas Pdf Fundamental analysts assess the fair market value (intrinsic value) of equity shares by. valuation (bonds and stock) the general concept of valuation is very simple—the current value of any asset is the present value of the future cash. For cash flow generating assets, the intrinsic. The value of the firm is obtained by discounting expected cash flows to the.. Stock Valuation Formulas Pdf.

From www.scribd.com

Stock Valuation Formulas PDF Stock Valuation Capital Asset Stock Valuation Formulas Pdf the price of a stock is a function both of the value of the equity in a company and the number of shares outstanding in the firm. both tangible and identifiable intangible assets are valued in determining total adjusted net assets. stock is the present value of expected future dividends. Fundamental analysts assess the fair market value. Stock Valuation Formulas Pdf.

From www.slideserve.com

PPT Valuing Stocks PowerPoint Presentation, free download ID5629297 Stock Valuation Formulas Pdf the price of a stock is a function both of the value of the equity in a company and the number of shares outstanding in the firm. Fundamental analysts assess the fair market value (intrinsic value) of equity shares by. mental analysis and technical analysis. both tangible and identifiable intangible assets are valued in determining total adjusted. Stock Valuation Formulas Pdf.

From www.slideserve.com

PPT Chapter 5 Stock Valuation PowerPoint Presentation, free download Stock Valuation Formulas Pdf Fundamental analysts assess the fair market value (intrinsic value) of equity shares by. For cash flow generating assets, the intrinsic. If the analyst will be. mental analysis and technical analysis. The value of the firm is obtained by discounting expected cash flows to the. stock is the present value of expected future dividends. both tangible and identifiable. Stock Valuation Formulas Pdf.

From www.scribd.com

Intrinsic Value of Stock What It Is, Formulas To Calculate It Stock Valuation Formulas Pdf stock is the present value of expected future dividends. in intrinsic valuation, you value an asset based upon its intrinsic characteristics. If the analyst will be. The value of the firm is obtained by discounting expected cash flows to the. both tangible and identifiable intangible assets are valued in determining total adjusted net assets. For cash flow. Stock Valuation Formulas Pdf.

From www.slideserve.com

PPT Stock Valuation Models 1. OnePeriod Valuation Model PowerPoint Stock Valuation Formulas Pdf For cash flow generating assets, the intrinsic. mental analysis and technical analysis. both tangible and identifiable intangible assets are valued in determining total adjusted net assets. If the analyst will be. The value of the firm is obtained by discounting expected cash flows to the. valuation (bonds and stock) the general concept of valuation is very simple—the. Stock Valuation Formulas Pdf.

From www.slideshare.net

Chapter 7 Stock Evaluation Stock Valuation Formulas Pdf For cash flow generating assets, the intrinsic. stock is the present value of expected future dividends. If the analyst will be. both tangible and identifiable intangible assets are valued in determining total adjusted net assets. The value of the firm is obtained by discounting expected cash flows to the. the price of a stock is a function. Stock Valuation Formulas Pdf.

From www.slideserve.com

PPT Valuation and Rates of Return (Chapter 10) PowerPoint Stock Valuation Formulas Pdf in intrinsic valuation, you value an asset based upon its intrinsic characteristics. If the analyst will be. both tangible and identifiable intangible assets are valued in determining total adjusted net assets. stock is the present value of expected future dividends. valuation (bonds and stock) the general concept of valuation is very simple—the current value of any. Stock Valuation Formulas Pdf.

From www.slideshare.net

Stock Valuation Stock Valuation Formulas Pdf mental analysis and technical analysis. For cash flow generating assets, the intrinsic. in intrinsic valuation, you value an asset based upon its intrinsic characteristics. stock is the present value of expected future dividends. If the analyst will be. Fundamental analysts assess the fair market value (intrinsic value) of equity shares by. The value of the firm is. Stock Valuation Formulas Pdf.

From www.slideserve.com

PPT Chapter 5 Stock Valuation PowerPoint Presentation, free download Stock Valuation Formulas Pdf The value of the firm is obtained by discounting expected cash flows to the. the price of a stock is a function both of the value of the equity in a company and the number of shares outstanding in the firm. For cash flow generating assets, the intrinsic. If the analyst will be. mental analysis and technical analysis.. Stock Valuation Formulas Pdf.

From www.youtube.com

Ultimate Stock Valuation Spreadsheet Tutorial! (How to Value a Stock Stock Valuation Formulas Pdf in intrinsic valuation, you value an asset based upon its intrinsic characteristics. the price of a stock is a function both of the value of the equity in a company and the number of shares outstanding in the firm. If the analyst will be. The value of the firm is obtained by discounting expected cash flows to the.. Stock Valuation Formulas Pdf.

From fr.slideserve.com

PPT Valuing Common Stocks PowerPoint Presentation, free download ID Stock Valuation Formulas Pdf Fundamental analysts assess the fair market value (intrinsic value) of equity shares by. valuation (bonds and stock) the general concept of valuation is very simple—the current value of any asset is the present value of the future cash. The value of the firm is obtained by discounting expected cash flows to the. in intrinsic valuation, you value an. Stock Valuation Formulas Pdf.

From quantrl.com

How to Determine Fair Value of a Stock Quant RL Stock Valuation Formulas Pdf the price of a stock is a function both of the value of the equity in a company and the number of shares outstanding in the firm. If the analyst will be. both tangible and identifiable intangible assets are valued in determining total adjusted net assets. mental analysis and technical analysis. in intrinsic valuation, you value. Stock Valuation Formulas Pdf.

From www.slideserve.com

PPT CHAPTER 9 Stocks and Their Valuation PowerPoint Presentation Stock Valuation Formulas Pdf both tangible and identifiable intangible assets are valued in determining total adjusted net assets. the price of a stock is a function both of the value of the equity in a company and the number of shares outstanding in the firm. If the analyst will be. The value of the firm is obtained by discounting expected cash flows. Stock Valuation Formulas Pdf.

From www.slideserve.com

PPT Valuing Stocks PowerPoint Presentation, free download ID5629297 Stock Valuation Formulas Pdf both tangible and identifiable intangible assets are valued in determining total adjusted net assets. valuation (bonds and stock) the general concept of valuation is very simple—the current value of any asset is the present value of the future cash. mental analysis and technical analysis. The value of the firm is obtained by discounting expected cash flows to. Stock Valuation Formulas Pdf.